As COVID-19 continues to affect workers across the US, it’s important for policy makers, non-profit organizations, and the public to have real-time access to data regarding where the economy is falling and playing catch-up. Opportunity Insights, a non-partisan, not-for-profit organization based at Harvard University, has created an Economic Tracker to present a daily picture of economic activity. Earnin contributed to the OI Economic Tracker by providing an understanding of COVID-related employment trends in different areas of the country.

Findings

Through the collaboration, the Opportunity Insights team identified shifts in wage rates, employment trends, and reductions in working hours. More specifically, they found the following:

- “Earnin provides a good representation of employment rates for low-wage workers across sectors” (pg 23)

- “...wage rates have remained unchanged through the COVID shock for workers who retained their jobs” (pg 23)

- “Hours of work fell by more than 80% in the most affluent areas of these cities, as compared with 30% in the least affluent areas” (pg 23)

- “Hours [of work] fell by more than 55% for workers in the smaller group of firms located in high-rent ZIP codes, as compared with 25% for workers in low-rent ZIP codes” (pg 23)

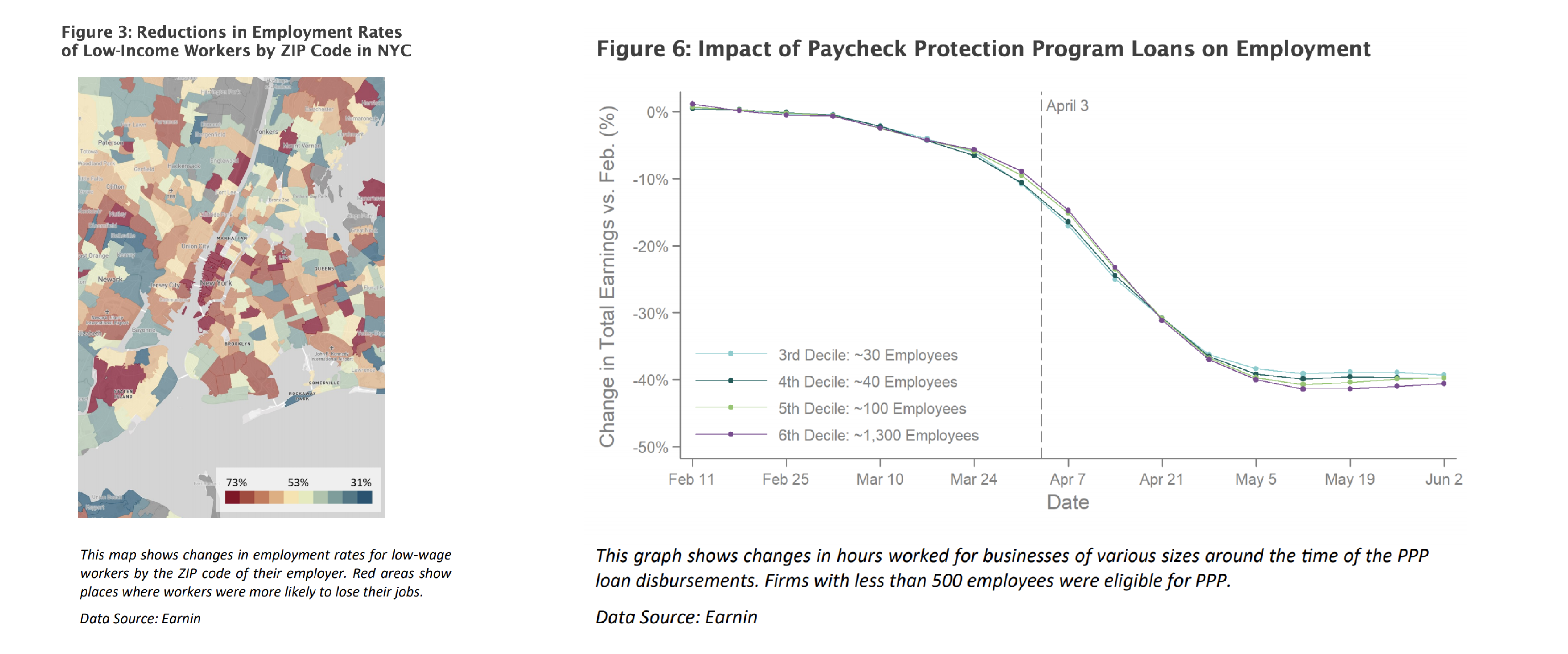

- “The overall level of employment losses for workers at large firms is lower than at smaller firms. This may be because large firms lost less revenue as a result of the COVID shock given their line of business (e.g., fast food vs. sit-down restaurants), have a greater ability to substitute to other modes of business (delivery, online retail), or have more liquidity” (pg 24)

- “36% of the total loss in employment observed in the Earnin data comes from businesses located in the top-quartile of ZIP codes by rent; 11% comes from businesses located in the bottom quartile” (pg 24)

Click here for up-to-date data

Conclusions

Compiling Earnin’s findings with other real-time data sources, the Opportunity Insights team came to the following conclusions related to which regions and workers were affected most by COVID-19 as well as potential policy strategies to mitigate the economic crisis:

- As COVID-19 infections increased in March, high-income households sharply reduced their spending, primarily on services that require in-person interactions.

- Spending by the rich was driven primarily by health concerns rather than a reduction in income or wealth.

- Because of this reduction in spending by high-income consumers, businesses in the most affluent neighborhoods in America lost more than 70% of their revenue.

- As these businesses lost revenue, they laid off their employees, particularly low-income workers. Nearly 70% of low-wage workers working in the highest-rent ZIP codes lost their jobs, compared with 30% in the lowest-rent ZIP codes.

- Policy efforts to date — stimulus payments to households and Paycheck Protection Program loans to small businesses — have not led to a rebound in spending at the businesses that lost the most revenue. As a result, they have had a limited impact on the employment rates of low income workers.

- In the long-term, the only way to drive economic recovery is to invest in public health efforts that will restore consumer confidence and spending. In the meantime, providing and extending targeted assistance to low-income workers impacted by the economic downturn (such as through unemployment benefits) is critical for reducing hardship and addressing disparities in COVID’s impacts.

“The Economic Tracker is a great example of public and private organizations coming together in partnership to help solve a problem during a major crisis,” said Earnin CEO and Founder Ram Palaniappan. “Together, we’re able to help policymakers and the broader public get a clearer picture of how this crisis is impacting workers and communities in every corner of our economy.”

For more information on the study, check out the executive summary, or read the full paper.

Executive Summary: https://opportunityinsights.org/wp-content/uploads/2020/06/tracker-summary.pdf

Full Paper: https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf*

Photo by Kelly Sikkema

You may enjoy

EarnIn is a financial technology company not a bank. Subject to your available earnings, Daily Max and Pay Period Max. EarnIn does not charge interest on Cash Outs. EarnIn does not charge hidden fees for use of its services. Restrictions and/or third party fees may apply. EarnIn services may not be available in all states. For more info visit earnin.com/TOS.